How to Submit Google AdSense Tax Information Correctly?

How to Submit Google AdSense Tax Information Correctly?

It was around June 2021, that Google announced the AdSense tax information from the creator who has a YouTube channel and blog. Those who are living outside of the United States of America should provide tax information on AdSense, on that day it was bad news for YouTubers to pay tax separately for Google AdSense as they tax to their Banks. There are few countries to pay tax for Google AdSense when they are making revenue. Also, on the other hand, there are few countries that won’t be able to pay tax to Google AdSense. The example, if you are out of the US, and you have views from a US country, then you have to pay at least 15% to 24% tax to Google AdSense.

So, whenever you are applying for Google AdSense, from scratch to AdSense tax, you will be asked several things. So, once your threshold is completed on Google AdSense, you will receive a private email to submit your tax information to Google AdSense. And this happened for all the creators living outside of the United States of America.

The reminder by Google AdSense is like this “We will be asking you to provide your Google AdSense tax information to determine the correct amount of taxes deducted”. If any application is wrong on the Google AdSense tax information will be able to cut around 24% tax from you.

Worldwide this is the biggest reminder from Google AdSense for all the creators. That they should submit their tax information for Google AdSense. So, if you fill in the tax information correctly then Google AdSense will cut only 15% if you won’t provide the tax information then Google will cut around 24% of your revenue.

How to Submit Google AdSense Tax Information Correctly?

This means that the creators should submit their complete tax information to Google AdSense. So, if you won’t submit the tax information Google will deduct up to 24% of revenue automatically, which includes worldwide earnings. So, if the creators should submit the Google AdSense tax information to claim the treaty, Google will cut 15% final.

📣 Attention creators!

If you’re a monetizing creator outside of the U.S., like India, important tax changes are coming later this year that may affect your YPP earnings ⚠️

Find out what’s happening, and what you need to do, below ⬇️

— YouTube Creators India (@YTCreatorsIndia) March 10, 2021

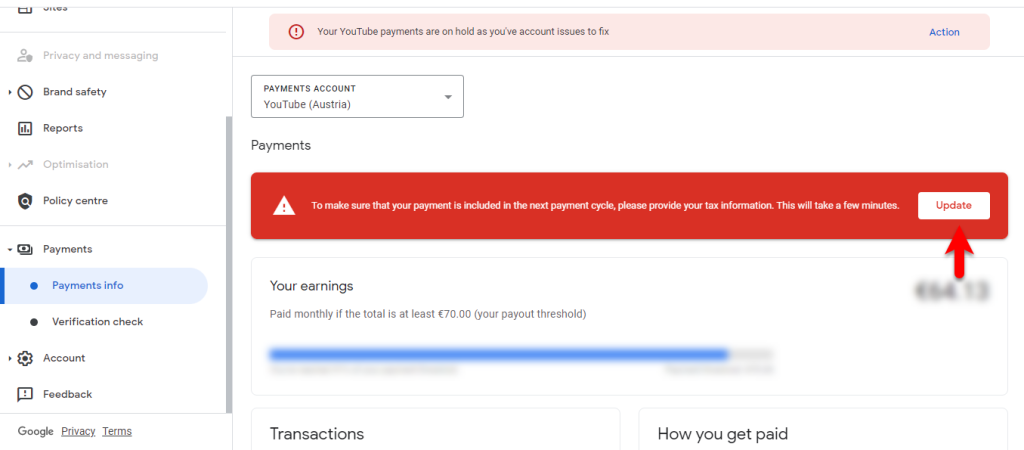

To submit your Google AdSense tax information simply, log in to your Google AdSense account. Then you might see the notice of tax information simply click on the update option.

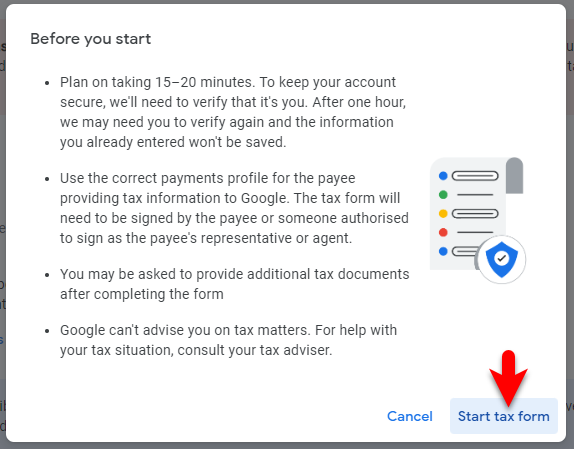

Before you start to submit Google AdSense tax information

- Plan on taking 15-20 minutes. To keep your account secure, we will need to verify that it’s you. After an hour, we may need you to verify again and the information you already entered won’t be saved.

- Use the correct payments profile for the payee providing tax information to Google. The tax form will need to be signed by the payee or someone authorized to sign as the payee’s representative or agent.

- You may be asked to provide additional tax documents after completing the form.

- Google can’t advise you on tax matters. For help with your tax situation, consult your tax adviser.

So, now click on the start tax form.

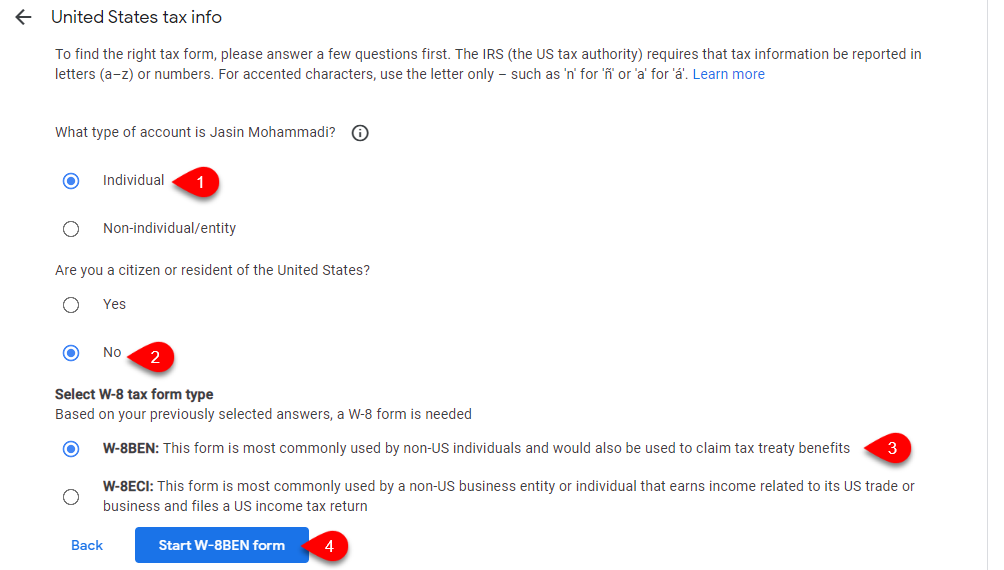

What type of account is it?

- select individual

Are you a citizen or resident of the United States? - No

Select W-8 tax form type - Select W-8BEN This form is most commonly used by non-US individuals and would also be used to claim tax treaty benefits

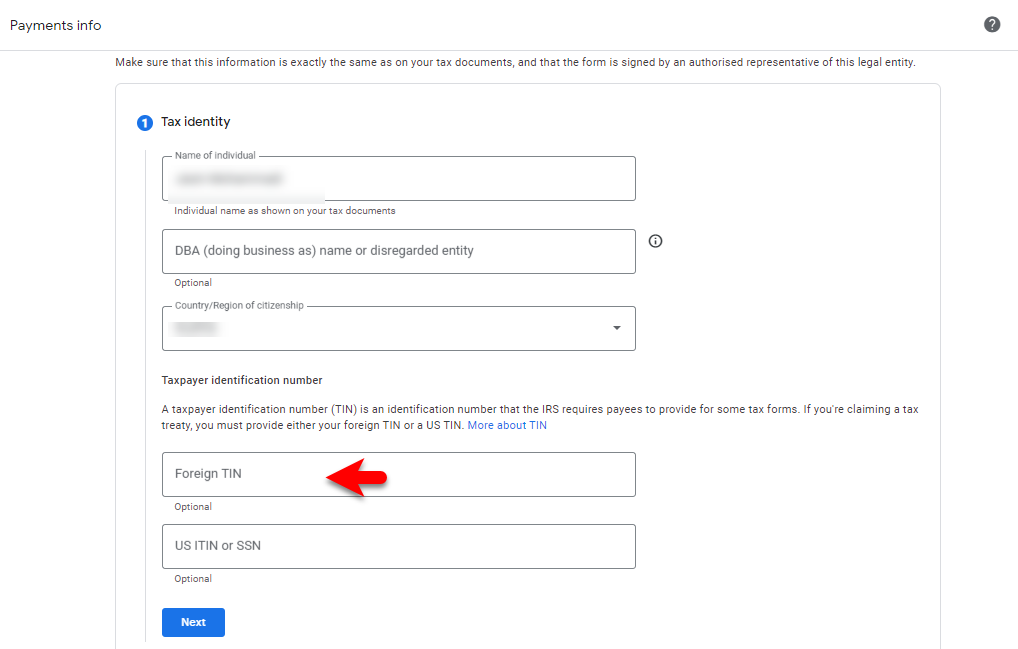

Fill out the form of tax identities, such as individual name, country region/citizenship, and Foreign TIN, then click on Next.

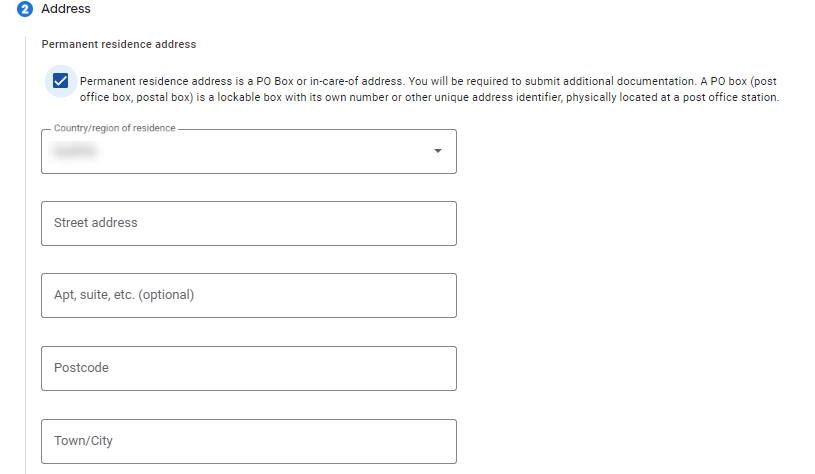

Check if the box of Permanent residence address is a PO Box or in-care-of address. You will be required to submit additional documentation. A PO Box (post office box, postal box) is a lockable box with its own number unique address identifier, physically located at a post office station. So, enter your country residence, street address, postal code, town, or city.

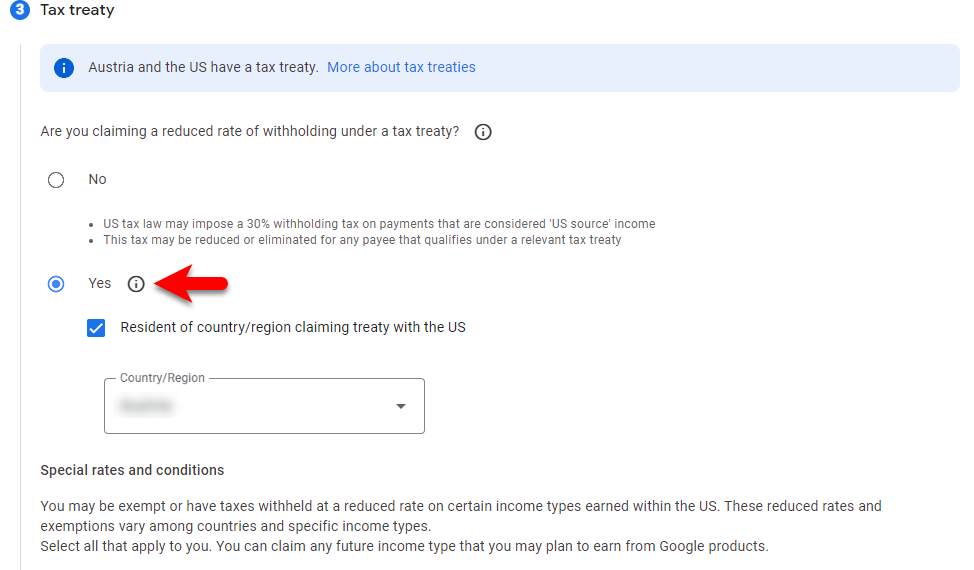

Are you claiming a reduced rate of withholding under a tax treaty?

- Select the Yes option, and check the box of residence of country/region claiming treaty with the US, then select your country.

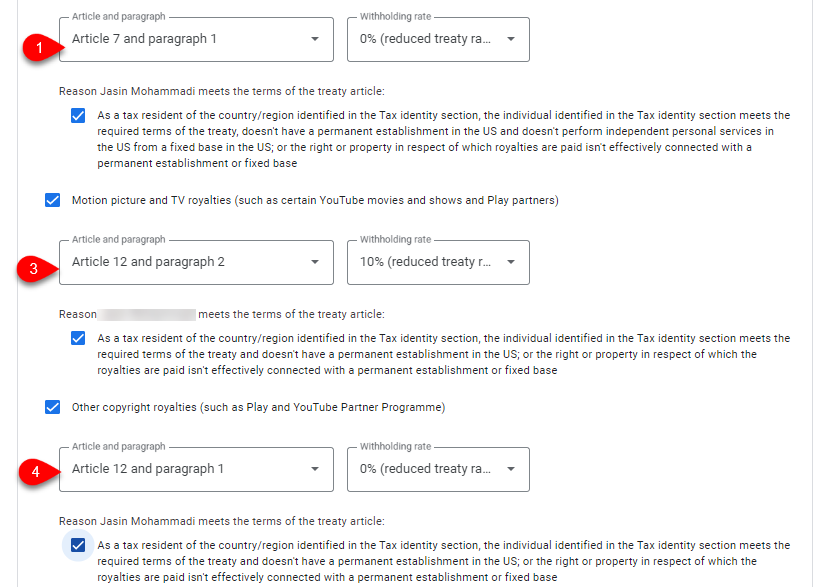

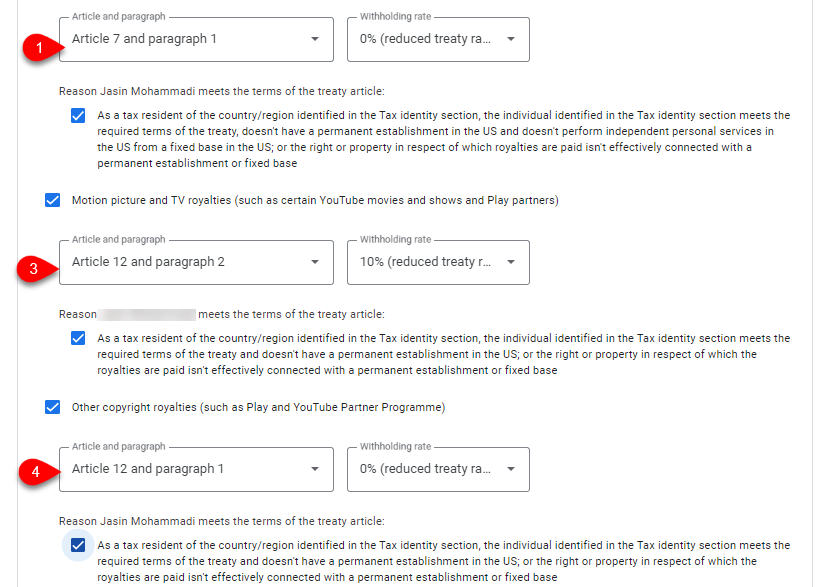

Now select article 7 and paragraph 1, 0% reduced treaty rate.

- Check the box of As a tax resident of the country, the region identified in the tax identity section, the individual identified in the tax identity section meets the required terms of the treaty, doesn’t have a permanent establishment in the US, and doesn’t perform independent personal services in the US form a fixed base in the US. Or the right or property with respect to royalties that are paid isn’t effectively connected with a permanent establishment or fixed base.

- Check the box for motion picture and TV royalties such as certain YouTube movies and shows and play partners.

Select article 12 and paragraph 2, 10% reduced treaty rate

- Check the box of As a tax resident of the country, the region identified in the tax identity section, the individual identified in the tax identity section meets the required terms of the treaty, doesn’t have a permanent establishment in the US, and doesn’t perform independent personal services in the US form a fixed base in the US. Or the right or property with respect to royalties that are paid isn’t effectively connected with a permanent establishment or fixed base.

- Check the box for Other copyright royalties such as Play and YouTube partner programs.

Select Article 12 and paragraph 1, 0% reduced treaty rate.

Also, check the boxes then click next.

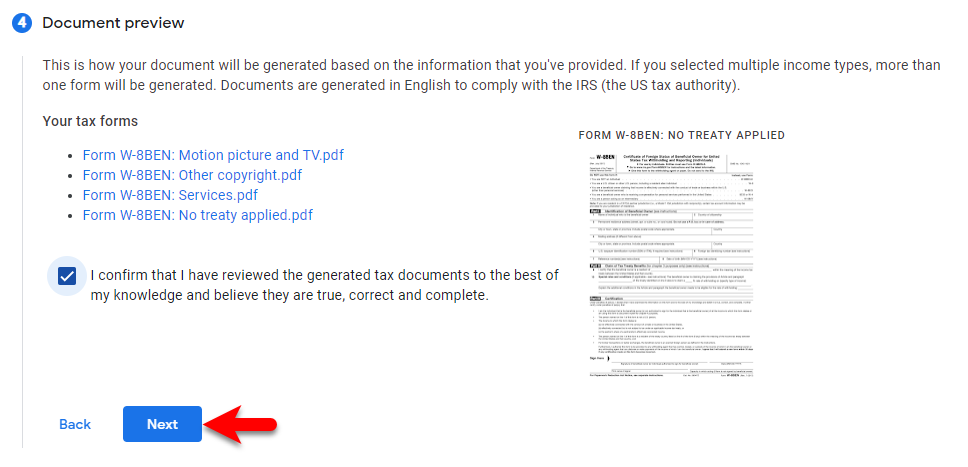

Document preview, this is how the document will be generated based on the information that you have provided. If you selected income types, more than one form will be generated. Documents are generated in English to comply with IRS (the US tax authority).

- Also check the box (I confirm that I have reviewed the generated tax documents to the best of my knowledge and believe they are true, correct, and complete, then click next.

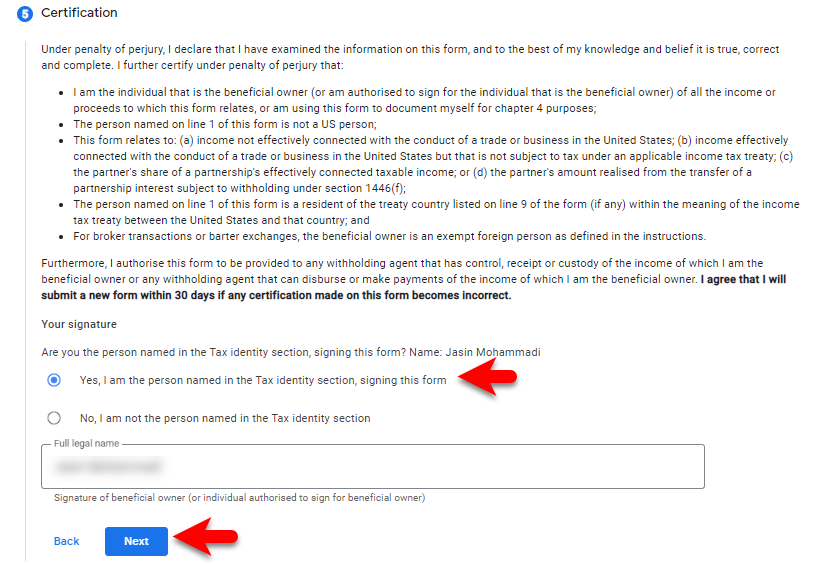

Select Yes, I am the person named in the tax identity section, signing this form. Enter your full legal name and click next.

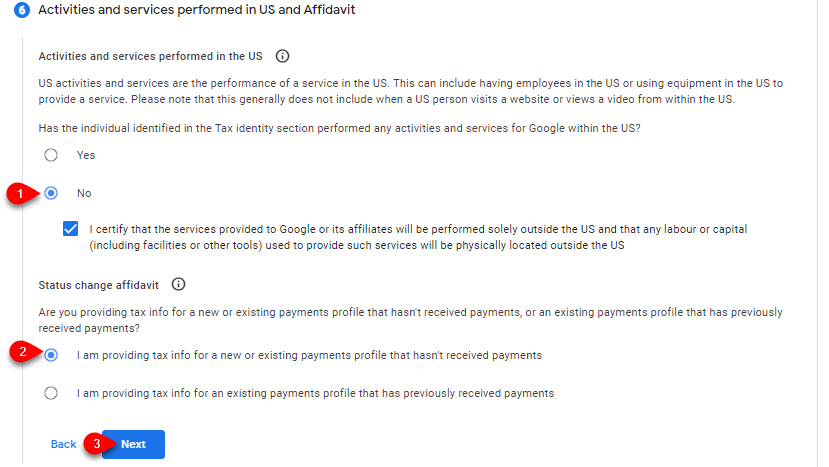

Activities and services performed in US and Afiidavit

Has the individual identified in the tax identity section performed any activities and services for Google within the US?

- Select the No option

Are you providing tax info for a new existing profile that hasn’t received payments, or an existing payments profile that has previously received payments?

- Select I am providing tax info for a new existing payments profile that hasn’t received payments, then click next.

Select the option Go paperless (Recommended), then check the box I accept the paperless delivery agreement and click on Submit option.

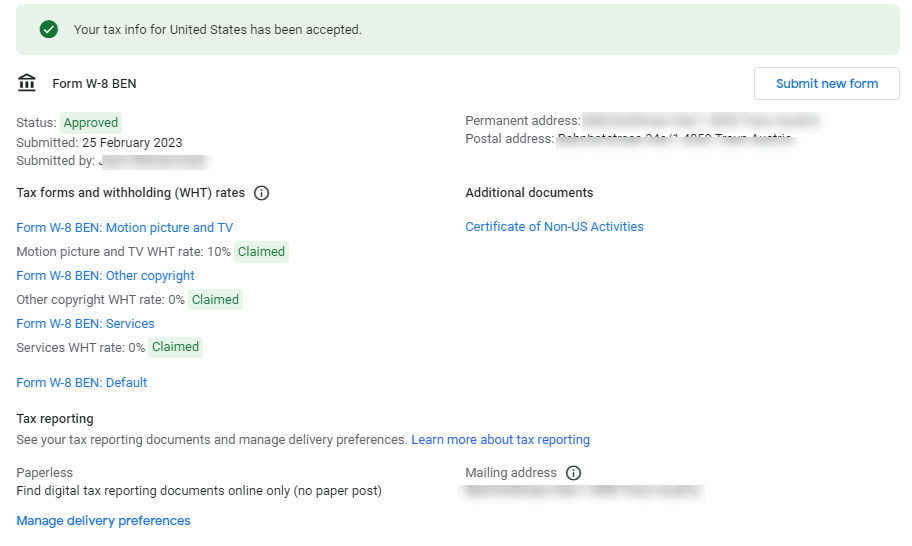

After you have submitted the Google AdSense tax form you will see like below screenshot.

Related:

- How To Connect Google AdSense With a WordPress Website?

- How to Link Payoneer Bank Account With Google AdSense?

Conclusion

When you have submitted the Google AdSense tax information, then you will receive an email in your Gmail. Simply review the tax information, and the next thing is you can edit your tax information any time you want it.

One Comment